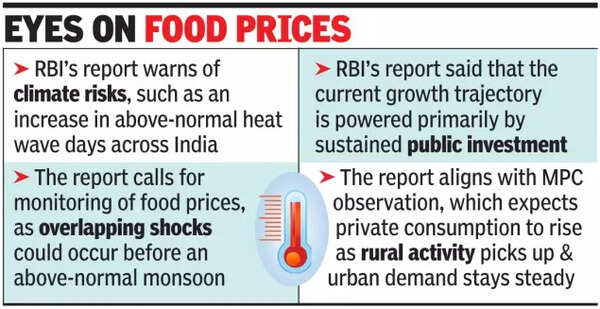

The report warns of climate risks, such as an increase in above-normal heatwave days across India. The report suggests monitoring of food prices, as overlapping price shocks could occur before an above-normal monsoon this year, as projected by the India Meteorological Department (IMD).

The report states that to achieve India’s developmental goals over the next three decades, the economy must grow at 8-10% annually to take advantage of the demographic dividend that started accruing in 2018 and will persist until 2055. “Conditions are shaping up for an extension of the trend upshift that took the average real GDP growth above 8% during 2021-24,” the report said.

According to govt data, the economy grew at 8.4% from Oct-Dec – its fastest pace in a year and a half. This resulted in three consecutive quarters of growth over 8%. Several agencies have raised their growth estimates for India on the back of a stellar Dec quarter performance.

The prediction of a normal monsoon augurs well for inflation in the months ahead, although prices of some food items including vegetables pose a risk. RBI governor Shaktikanta Das had said that inflation has come down significantly but remained above the 4% target and food inflation continues to exhibit considerable volatility impeding the ongoing disinflation process. He had also said that high and persistent food inflation could unhinge anchoring of inflation expectations which is underway.

The report said that the current growth trajectory is powered primarily by capital deepening, fuelled by sustained public investment, and supported by productivity improvements. It also quotes the Asian Development Bank (ADB), highlighting a renewed increase in private investment. The report aligns with the MPC observation, which expects private consumption to increase as rural activity picks up and urban demand remains steady due to improving consumer confidence.