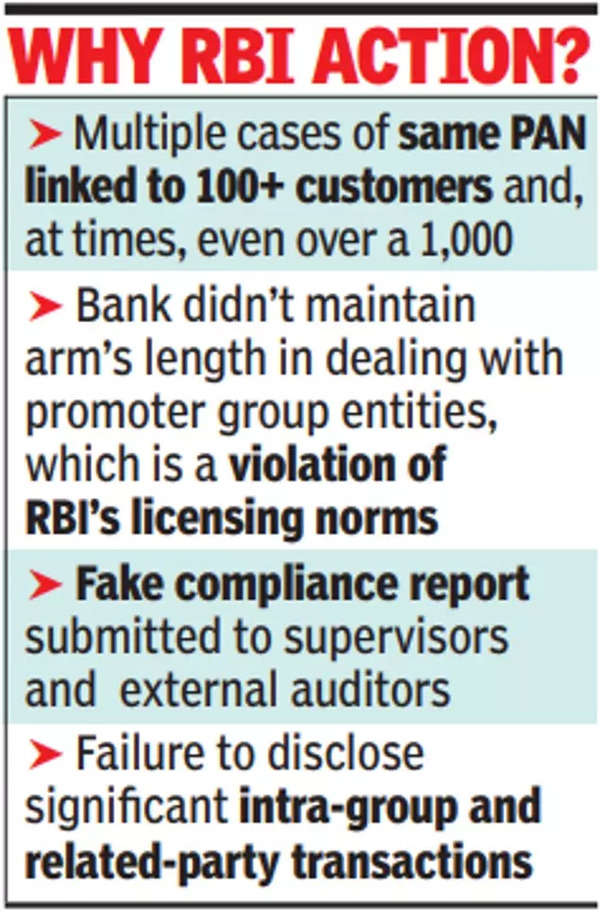

The regulator noticed multiple irregularities including alleged absence of KYC for a very large number of customers, and lakhs of instances of failure in PAN validation. In thousands of cases, the same PAN was linked to more than 100 customers and, in some cases, it was linked to more than 1,000 customers – revealing massive misuse.

A Paytm Payments Bank spokesperson told TOI, “The bank always upheld compliance with supervisory instructions in its interactions with the regulator from time to time. We, therefore, request you to be guided by the press release of RBI dated January 31 and refrain from any further speculation.”

‘RBI move part of ongoing compliance process’

The recent direction from RBI is a part of the ongoing supervisory engagement and compliance process,” a Paytm Payments Bank spokesperson said in response to a detailed questionnaire by TOI. In the case of prepaid instruments, RBI found there were transactions running into crores of rupees with the minimum permitted KYC, which was a violation of regulatory norms, sources told TOI.

On January 31, after months of discussions with Paytm Payments Bank management, RBI banned it from accepting fresh funds in accounts and wallets from March, although withdrawals and transfers are permitted. At that time, the regulator had not disclosed details of what led to the drastic action.

The entity is facing a situation where law enforcement agencies have frozen lakhs of accounts and wallets for their use in committing frauds, sources pointed out. As reported by TOI on Thursday, for over two years, the bank management failed to correct the alleged irregularities flagged by RBI. The entity is also accused of submission of false compliance reports to RBI’s supervision team and external auditors on several occasions.

In addition, RBI has observed multiple instances of its licensing conditions being violated. For instance, the bank’s financial and non-financial businesses were suspected to be intertwined with its promoter with absolute dependence on parent One97 Communication’s IT infrastructure. In the absence of operational segregation, several transactions were allegedly routed through parent entity-owned apps, raising serious concerns over data privacy and data sharing, sources said.

In addition, the bank had a significant amount to be paid to One97 Communications, which were not disclosed in the financial statements. RBI also found instances of agreements being revised, allegedly to benefit the parent or its group companies.