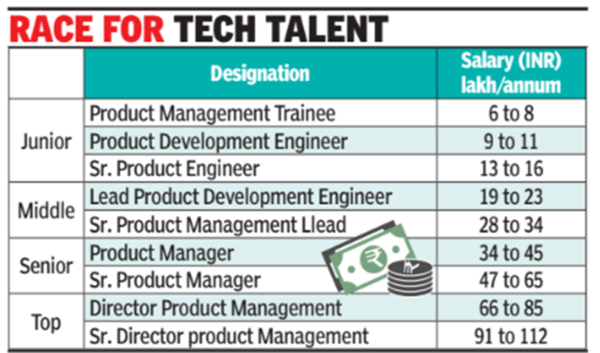

A report by the global management and strategy consulting firm Zinnov showed that entry-level product managers in India start with a median salary of Rs 8 lakh a year, while senior product development engineers receive an annual compensation of Rs 13 lakh to Rs 16 lakh. At the mid-level, a senior product management lead earns anywhere between Rs 28 lakh to Rs 34 lakh. At the senior level, a director of product management takes home anywhere between Rs 66 lakh to Rs 85 lakh, and as a senior director of product management, they earn between Rs 91 lakh and Rs 1.2 crore.

Pari Natarajan, CEO and co-founder of Zinnov, said, “Product management has evolved remarkably over time, adapting to changing industry demands. Companies in India have adopted distinct product management structures-hiring a technical leader versus an operational leader who will co-create and steer product portfolio roadmaps.” Natarajan noted that the maturity of companies embracing product management roadmaps has evolved from long development cycles in the waterfall model to lean principles emphasizing a minimum viable product (MVP), rapid prototyping, and continuous feedback loops. It has transitioned to a dynamic approach to product management focusing on the iterative development of the build-measure-learn feedback loop. Currently, the spotlight is on a data-driven product management approach of continuous improvement based on data insights and user feedback.

“It used to take about 5-6 years for companies from setting up to gaining ownership of a portfolio of products, but now, it takes less than two years to drive product ownership, roadmap, engineering, and support and yet create value for their customers by collapsing timelines,” he said. Zinnov mentioned that India has a talent base of over 160,000 product management professionals, with Bengaluru, NCR, and Mumbai accounting for two-thirds of the product management talent.

Take RapidAI, for instance. The company has over a dozen FDA-approved models in vascular and neurovascular disease treatment, serving over 2,200 hospitals across 100 countries. RapidAI has analyzed over 11 million scans with a 30% year-on-year increase in volumes. RapidAI set up its GCC in India in 2022, driving product design and development for its hybrid technology platform, Rapid Edge Cloud. Edge Cloud’s hybrid architecture, combining on-premises and cloud capabilities, addresses the issue of cloud outages by allowing essential AI services to continue, thus ensuring continued patient care.

Natarajan said that some of the GCCs are creating a new product innovation playbook from India. “The Japanese e-commerce platform Mercari India’s team has been integral to creating an intuitive platform that connects buyers and sellers nationwide and comprises platform engineers, backend engineers, and mobile developers.” Among the recent innovations are Merpay, a mobile payment service seamlessly integrated within the Mercari Marketplace app; Mercoin, dedicated to exploring services revolving around cryptocurrency assets and blockchain technologies; and Shops, an e-commerce platform empowering individuals to launch their own online stores using their smartphones.

Companies are drawn to India for tech talent also because of the scale and diversity of skill sets. “Many companies used to look at Eastern Europe. And Ukraine’s cost was comparable to India. Over time, Poland and Romania have become too expensive. We did a study for one of our customers, and we found that there is more negative unemployment in tech because everybody who can be deployed is deployed. Customers are wary of the war situation in Eastern Europe. Many companies have GCCs also in manufacturing, industrial engineering, and automotive companies have a large presence in China. They want to de-risk China. It’s almost like China Plus One in manufacturing and India Plus One in GCCs. India Plus One is Latin America. But India is gaining prominence for product talent,” Natarajan added.