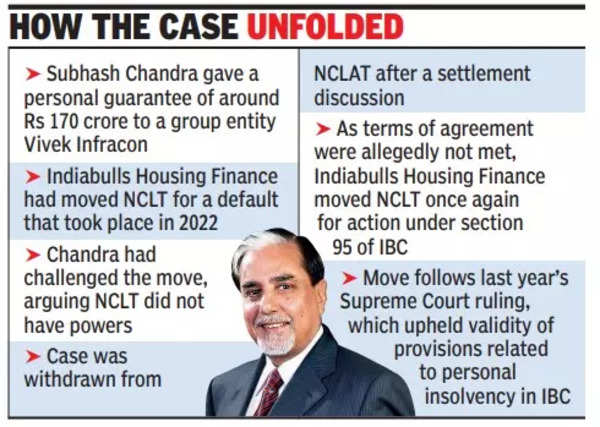

Chandra had given a personal guarantee of around Rs 170 crore to a group entity Vivek Infracon and Indiabulls Housing Finance had moved NCLT for a default that took place in 2022.Chandra had challenged the move, arguing NCLT did not have powers.

Following discussion around a settlement, the case was withdrawn from the National Company Law Appellate Tribunal (NCLAT). Subsequently, the terms of the agreement were allegedly not met, resulting in Indiabulls Housing Finance approaching the tribunal (NCLT) once again for action under section 95 of the Insolvency & Bankruptcy Code (IBC). The move also followed last year’s Supreme Court ruling, which upheld the validity of provisions related to personal insolvency in IBC.

The apex court ruling has opened the floodgates for creditors to initiate action against a host of corporate chiefs even in cases where they have not been able to recover the full amount in corporate insolvency cases. On Monday, NCLT pronounced the order, but a detailed judgment is awaited. It, however, rejected pleas filed by two other creditors, IDBI Trusteeship and Axis Bank.

“The copy of the order is awaited. Appropriate steps will be actioned in accordance with the applicable law,” says a statement from office of Chandra. Chandra can appeal against the order in the appellate tribunal (NCLAT).

Unlike a corporate insolvency resolution process, where the promoters are ousted and a resolution professional takes charge, along with a committee of creditors, personal insolvency proceedings work differently. As a first step, NCLT will appoint a resolution professional.

Once an application is admitted, there is a moratorium, when every legal action or proceeding pending in respect of any debt owed by the personal guarantor is deemed to have been stayed. Once claims are received from creditors, the personal guarantor prepares a repayment plan, along with the resolution professional, which may involve restructuring of loans or transfer or sale of some assets. So far, progress on personal insolvency cases has been slow.