MUMBAI: After 20 months since its listing, LIC stock performance on Tuesday brought cheers to at least one set of its investors.

As the stock price of the insurance major hit the Rs 900-mark on BSE, policyholders recorded positive returns. During its IPO, although the stock was offered at Rs 949 per share, its policyholders got them at Rs 889, and retail shareholders and its employees paid Rs 904.

In the last two months, LIC’s stock price has gained 45%, moving from Rs 615 to Rs 893. With a market value of Rs 5.6 lakh crore, it is the 10th most valued company in India and second most valued government-run enterprise behind SBI, which has a market value of Rs 5.7 lakh crore, BSE data showed.

During the day, LIC’s stock price — for the first time since its listing day trading on May 17, 2022 — touched the Rs 900 mark on BSE and closed at Rs 893. At this close, its policyholders are now in-the-money, though just marginally. There’s a high chance retail investors and its employees would soon be in profit if the current rally in the stock continues.

As the stock price of the insurance major hit the Rs 900-mark on BSE, policyholders recorded positive returns. During its IPO, although the stock was offered at Rs 949 per share, its policyholders got them at Rs 889, and retail shareholders and its employees paid Rs 904.

In the last two months, LIC’s stock price has gained 45%, moving from Rs 615 to Rs 893. With a market value of Rs 5.6 lakh crore, it is the 10th most valued company in India and second most valued government-run enterprise behind SBI, which has a market value of Rs 5.7 lakh crore, BSE data showed.

During the day, LIC’s stock price — for the first time since its listing day trading on May 17, 2022 — touched the Rs 900 mark on BSE and closed at Rs 893. At this close, its policyholders are now in-the-money, though just marginally. There’s a high chance retail investors and its employees would soon be in profit if the current rally in the stock continues.

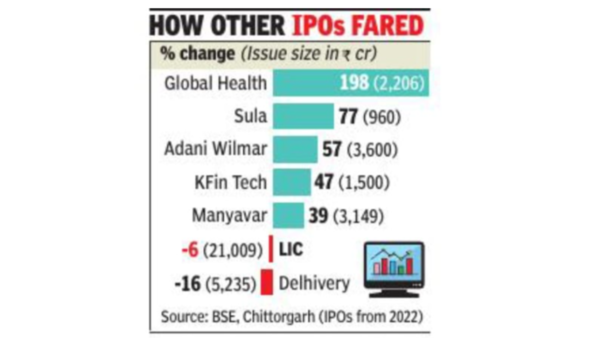

A look at the stocks that were listed in 2022 shows that other than LIC, Delhivery is the other high-profile company whose stock is still in the negative territory compared to its IPO price. On Tuesday, the stock closed at Rs 410, still 16% down from its IPO price of Rs 487.

In comparison, most of the other companies that went public the same year have given strong returns to investors. The list of winners includes Global Health (up 198%), Sula Vineyards (up 77%) and Adani Wilmar (up 57%). Lately, analysts have also turned positive on the stock. “Multiple tailwinds to help sustain (LIC’s) share price outperformance,” said a recent report by Emkay Global Financial Services.

The broking house has revised its target price for LIC to Rs 975.