The executives told ET’s Writankar Mukherjee that RIL aims to establish its own manufacturing facilities in the future, once the brand secures a significant market share.

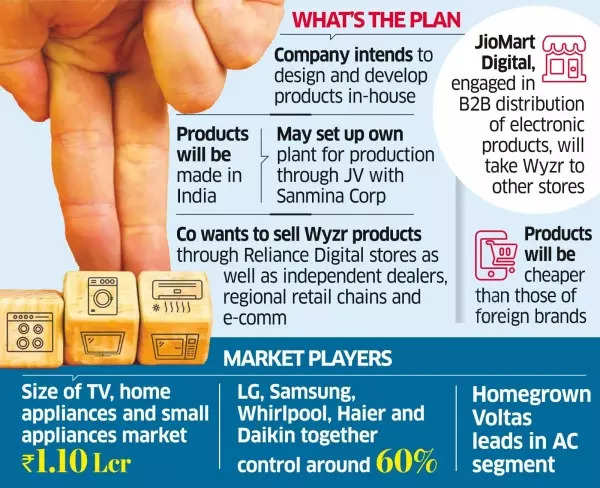

Reliance Retail, the retail arm of RIL, has recently introduced Wyzr air coolers and intends to expand the product range to include televisions, washing machines, refrigerators, air conditioners, small appliances, and LED bulbs. The company plans to develop and design these products internally, as it strives to create a homegrown brand in a market currently dominated by international labels.

Reliance plans for consumer electronics, home appliances

Prior to this, Reliance Retail had launched a private label brand called Reconnect, which featured products manufactured by third-party companies. During RIL’s fourth-quarter earnings call on April 22, Reliance Retail’s chief financial officer, Dinesh Taluja, mentioned the launch of the new brand without providing further details.

Reliance plans to distribute Wyzr products through various channels, including its own Reliance Digital stores, independent dealers, regional retail chains, and e-commerce platforms like Amazon and Flipkart, according to sources familiar with the matter. The company’s B2B electronic product distribution arm, JioMart Digital (JMD), will be responsible for taking Wyzr to other stores. In FY24, JMD experienced a 20% growth in its merchant base.

Also Read | 5 lakh ‘Apployments’: Apple ecosystem to create huge number of jobs in 3 years; iPhone maker may move half its supply chain from China to India

Wyzr products are expected to be more affordable compared to established brands such as LG, Samsung, and Whirlpool, which currently hold a dominant position in categories like TVs, refrigerators, and washing machines. In the air conditioner market, Tata-owned Voltas leads, closely followed by multinational companies like LG and Daikin.

An executive stated, “Reliance had earlier disrupted the MNC-dominated feature phone market with its own product, JioPhone. It wants to replicate the success in electronics in a sustained manner, riding on the make-in-India wave.”

In 2022, Reliance acquired a 50.1% stake in the Indian entity of Sanmina, a US-based manufacturing solution company, for Rs 1,670 crore to expand its presence in the electronics manufacturing sector. Sanmina operates a 100-acre campus in Chennai, where it may establish a plant for Wyzr products, according to an executive. However, the executive added, “But nothing has been finalised and the priority is to launch the products right now.”

Also Read | Significant milestone! Gautam Adani says Adani Green is now India’s first “das hazari” in renewable energy space

Reliance Retail did not respond to inquiries regarding their plans to launch their own brand of consumer electronics. Mirc Electronics managing director Vijay Mansukhani declined to comment on the matter, and an email sent to Dixon remained unanswered.

In the past, Reliance Retail attempted to sell televisions and appliances under the brand name Reconnect, but the success was limited as these products were designed and manufactured by partners. The products were sold exclusively through Reliance Digital stores without significant marketing efforts and were intended to compete with private label products from Future Group’s Koryo and Tata-owned Croma.

Currently, Reliance Retail continues to use the Reconnect brand for accessories. The company acquired the license for BPL and Kelvinator brands a few years ago and introduced a limited range of TVs, refrigerators, and washing machines without gaining substantial market share. Local companies like Dixon, Mirc, and PG Electroplast were responsible for the design and manufacturing of these products, whereas others were imported from China and Indonesia, being produced by TCL, Midea, and Toshiba.

“Reliance management felt that it needed its own brand where it can firmly control the product design and manufacturing to win in this market,” an executive said.

During the earnings call, Taluja mentioned that the FMCG business, which completed its first full year of operations, is “scaling up nicely.” He highlighted that brands like Campa in the beverages space and Independence in the staples segment “had very strong traction and got very strong customer acceptance.” Taluja also stated that the company is “building the supply chain for these products so that we have a localised supply chain in different parts of the country and looking to scale up these businesses.”