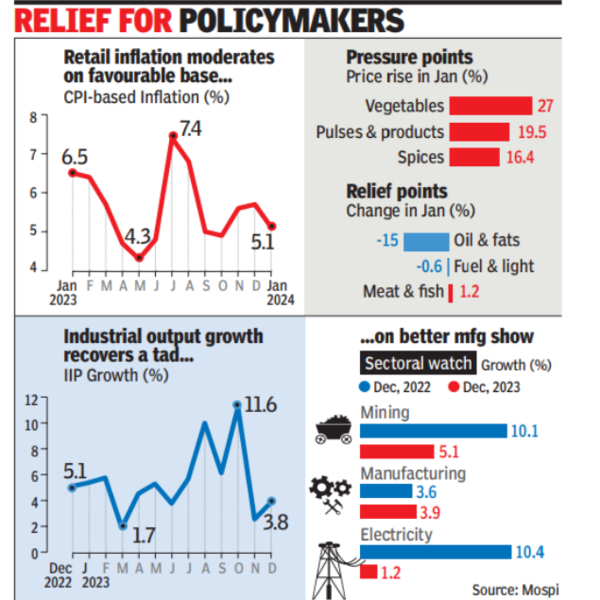

NEW DELHI: Retail inflation moderated to a three-month low in Jan on the back of a favourable base and some easing in food and fuel prices, while industrial output growth rebounded in Dec, led by manufacturing.

Data released by the National Statistical Office (NSO) on Monday showed inflation, as measured by the Consumer Price Index (CPI) rose an annual 5.1% in Jan, slower than the previous month’s 5.7%. The food price index slowed to 8.3% from the previous month’s 9.5%. Rural inflation was higher at 5.3% while urban was at 4.9%. Oils and fats prices fell nearly 15% during the month while fuel and light contracted 0.6%.

“Ongoing deflation in the fuel and light category also continues to support inflationary prints. Core inflation remained subdued and moderated further, consistently staying below the 4% threshold for two consecutive months, mainly due to muted consumption demand and a moderation in global commodity prices,” said Rajani Sinha, chief economist at ratings agency CareEdge.

“Looking ahead, a favourable base effect is expected to persist until July 2024, helping absorb potential upward risks to price pressures to a certain extent. Additionally, the arrival of the early harvest in the market over the next few months is anticipated to alleviate price pressures further. For FY24, we expect inflation to average 5.4%, with fourth quarter FY24 at 5.1%,” said Sinha, while calling for close monitoring of cereals, pulses, and spices, which pose a risk of potentially broadening price pressures.

Data released by the National Statistical Office (NSO) on Monday showed inflation, as measured by the Consumer Price Index (CPI) rose an annual 5.1% in Jan, slower than the previous month’s 5.7%. The food price index slowed to 8.3% from the previous month’s 9.5%. Rural inflation was higher at 5.3% while urban was at 4.9%. Oils and fats prices fell nearly 15% during the month while fuel and light contracted 0.6%.

“Ongoing deflation in the fuel and light category also continues to support inflationary prints. Core inflation remained subdued and moderated further, consistently staying below the 4% threshold for two consecutive months, mainly due to muted consumption demand and a moderation in global commodity prices,” said Rajani Sinha, chief economist at ratings agency CareEdge.

“Looking ahead, a favourable base effect is expected to persist until July 2024, helping absorb potential upward risks to price pressures to a certain extent. Additionally, the arrival of the early harvest in the market over the next few months is anticipated to alleviate price pressures further. For FY24, we expect inflation to average 5.4%, with fourth quarter FY24 at 5.1%,” said Sinha, while calling for close monitoring of cereals, pulses, and spices, which pose a risk of potentially broadening price pressures.

In his monetary policy statement last week, RBI governor Shaktikanta Das had said that the battle against inflation was far from over. “The last mile of disinflation is always the most challenging and that has to be kept in mind,” he had said. Das stated that RBI would persist in maintaining scarcity of money to control prices.

Separate data showed industrial output staging a marginal rebound with 3.8% growth in Dec, 2023. Manufacturing led the recovery, rising 3.9% in Dec compared to 3.6% expansion in the year earlier period.