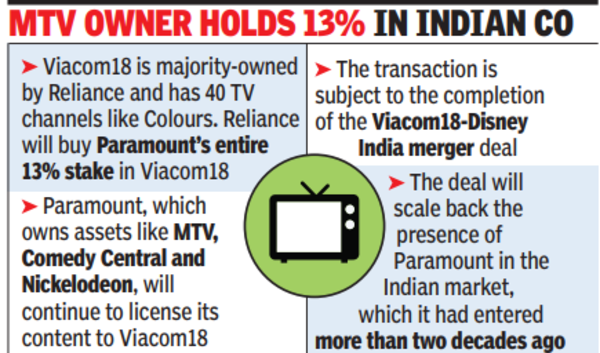

The move comes a fortnight after Reliance decided to merge the business of Viacom18 with the India unit of Walt Disney.Reliance will buy Paramount’s entire 13% share in Viacom 18, increasing its stake to nearly 70.5% from about 57.5%.

The development highlights Reliance’s strategy of going beyond its mainstay business of refining and petrochemicals and upping its play in consumer-facing businesses. Towards this, it has been buying assets in retail, fashion and digital.

The deal will scale back the presence of Paramount, best known for owning entertainment assets like the eponymous Paramount Studios, CBS television network, MTV, Comedy Central and Nickelodeon, in India, which it had entered more than two decades ago. It will, however, continue to license its content to Viacom18 after the deal is closed.

The transaction is subject to the completion of the Viacom18-Walt Disney India merger deal. The share-sale will help Paramount improve its balance sheet even though international media reports have deemed it as a potential takeover target.

In 2007, Viacom Inc (now part of Paramount) formed a 50:50 joint venture with TV18 India, a company then owned by Raghav Bahl, to establish Viacom18. This company launched Hindi entertainment channel Colors and managed Viacom’s TV channels like MTV, VH1 and Nickelodeon.

In 2014, TV18 India was taken over by Reliance and in 2023, Viacom 18 was combined with one of the entities of Reliance, making Paramount a smaller shareholder of the broadcaster. The 2023 transaction also saw Bodhi Tree Systems, an investment venture of James Murdoch’s Lupa Systems and former Walt Disney India head Uday Shankar, acquiring a 13.1% stake in Viacom18.

Once the businesses of Viacom18 and Walt Disney India are combined, Reliance will hold just over 16% in the merged entity, Viacom18 will own about 47% and Disney close to 37%.

Like Paramount, Disney too will see its presence scaled back in India, one of largest economies in the world.

The Reliance-Disney combination will make the business environment difficult for smaller players like Zee and Sony as they will have to individually compete with a dominant player. Analysts expect the Reliance-Disney consolidation to benefit the unified entity as its bargaining power will increase, helping it to command better advertising rates. It could also see rationalisation in content costs, leading to margin improvement, they said.

Zee and Sony had attempted to merge their local operations but the deal collapsed after Sony walked away from it. Had the merger happened, Zee-Sony would have been the largest player in the sector after Reliance-Disney.