Several other banks have, however, not decided on the process that they would adopt during the four-month long exercise to exchange and deposit the highest denomination notes from Tuesday. All banks will be required to put in place a system they intend to adopt on Monday.

SBI, the country’s largest lender, made its position clear in a communication to its chief general managers on Saturday, tweaking a set of instructions that were issued a day before. In its Sunday edition, TOI had reported that the RBI has not mandated submission of identity proof or filling up of any form. It only wants deposit rules to be followed.

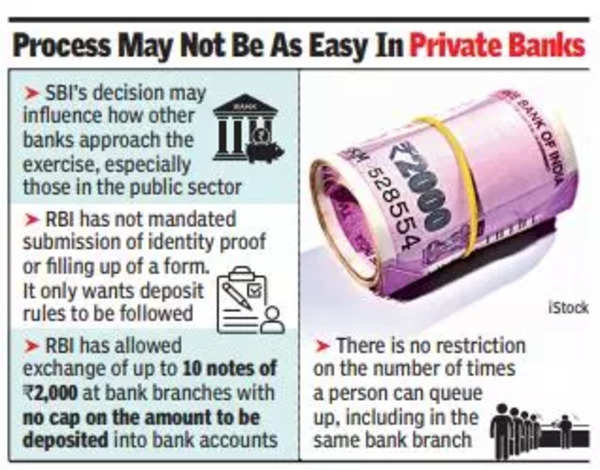

While SBI’s decision may influence how other banks approach the exercise, especially those in the public sector, it may not be as easy to exchange notes in private banks.

Even getting a bank draft from a private lender where you do not have a bank account is not an easy task with several branches turning down customers saying they are not allowed to provide the facility. And, those without an Aadhaar or PAN in their possession often are made to follow a long process. During demonetisation too, public sector players had to bear the bulk of the burden especially when it came to those without a bank account.

Over the weekend, state-run banks were consulting their zonal offices to lay down the process and facilitate the exchange. The RBI has allowed exchange of up to 10 notes of Rs 2,000 at bank branches with no cap on the amount to be deposited into bank accounts.

Sources said that there is no restriction on the number of times a person can queue up, including in the same bank branch. The idea is to facilitate the exchange of the high denomination notes as part of RBI’s “clean note policy”.