In the last festival quarter (Oct-Dec 2023), Kanpur and Bara Banki in Uttar Pradesh were among the top ten cities in terms of consumer loan growth, replacing Jaipur and Surat.

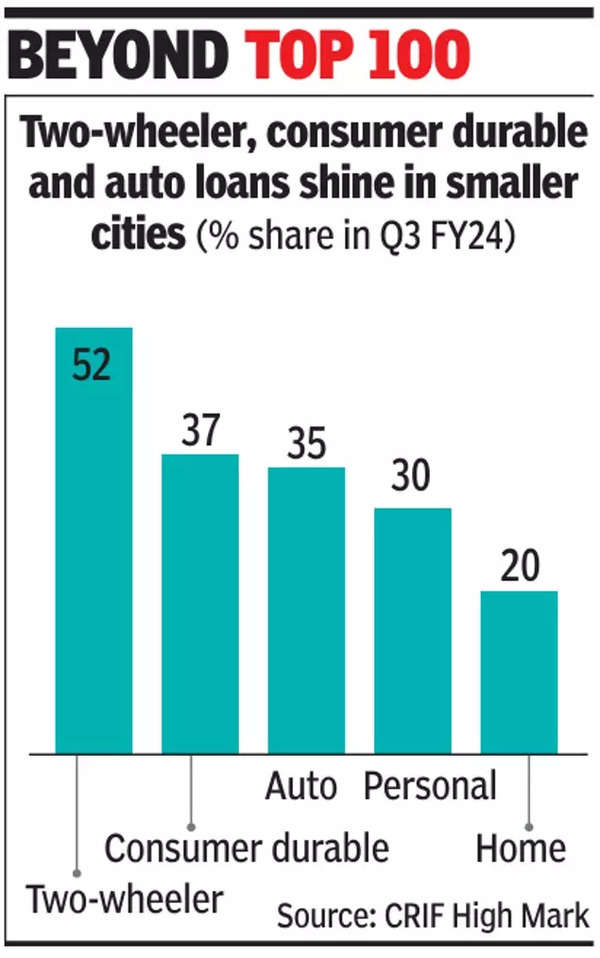

According to an analysis by credit bureau CRIF High Mark, cities outside the top 100 had the largest share of auto, two-wheeler, and consumer loans disbursed in Q3 FY24.The study grouped the cities into four categories: top eight, top nine-50, top 51-100, and cities beyond the top 100. The share of the top 10 cities has dropped from 42% to 38.3% year-on-year in consumer loans.

Sanjeet Dawar, MD of CRIF High Mark, said, “What is interesting to note is that credit demand during this period is not just limited to larger geographies. Loans such as two-wheeler and consumer durable have seen an increasing share come from cities beyond the top 100, from Q3 FY23 to Q3 FY24.”

The top five states for consumer loan originations are Maharashtra, Karnataka, Uttar Pradesh, Tamil Nadu, and Telangana. Uttar Pradesh has moved up one place from last year, displacing Tamil Nadu to become the third-largest state for consumer loans.

During the festive season, growth in consumer durable loans has accelerated 27% from 13% last year. Growth has also almost doubled in the case of home loans to 8.9% in Q3 FY24 from 4.9% in the year-ago period. Among loans disbursed to individuals during the quarter, home loans were the highest during the quarter at Rs 2.5 lakh crore followed by personal loans at Rs 2.3 lakh crore.