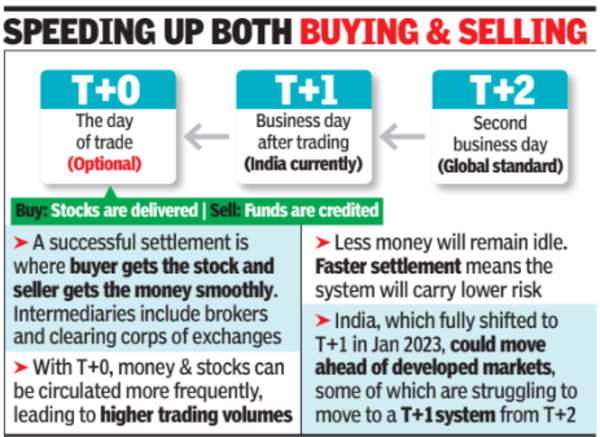

MUMBAI: To offer investors in India the fastest stock trading and settlement service in the world, BSE and NSE, will start trading 25 stocks in an experimental (beta) version from Thursday under T+0 settlement cycle. This ‘same day’ settlement system would also lower risks for the market, while releasing funds for investors to use for more trading and investing.

Under the T+0 system, stocks bought and sold between 9.15am and 1.30pm would be settled by the end of the day.Currently, the Indian market trades under the T+1 settlement system under which the buyers get the stocks in their demat accounts on the next working day after the day of the trade. Similarly, the sellers get funds in their bank accounts one working day after the day of trade.

On Wednesday, BSE published the list of 25 stocks which are eligible to be settled under the T+0 settlement cycle. The stocks included are Ambuja, Ashok Leyland, Bajaj Auto, Bank of Baroda, BPCL, Birlasoft, Cipla, Coforge, Divis Labs, Hindalco, Indian Hotels, JSW Steel, LIC Housing Finance, LTI Mindtree, MRF, Nestle India, NMDC, ONGC, Petronet LNG, Samvardhana Motherson International, SBI, Tata Communications, Trent, Union Bank of India and Vedanta.

Although a same day settlement was in the planning stage for more than a year now, on March 15, Sebi in its board meeting had given it the go-ahead to launch a beta version and said it would review its progress after three and six months.

Last week, Sebi had asked market infrastructure institutions to work on the same. The new settlement cycle will be optional in nature for investors and it will have a separate trading window in which the trading for the day will end at 1.30pm. Sebi also said that some select brokers will be allowed to offer this faster settlement to its clients. Till late Wednesday, the list of selected brokers was not published by the bourses.

Under the T+0 system, stocks bought and sold between 9.15am and 1.30pm would be settled by the end of the day.Currently, the Indian market trades under the T+1 settlement system under which the buyers get the stocks in their demat accounts on the next working day after the day of the trade. Similarly, the sellers get funds in their bank accounts one working day after the day of trade.

On Wednesday, BSE published the list of 25 stocks which are eligible to be settled under the T+0 settlement cycle. The stocks included are Ambuja, Ashok Leyland, Bajaj Auto, Bank of Baroda, BPCL, Birlasoft, Cipla, Coforge, Divis Labs, Hindalco, Indian Hotels, JSW Steel, LIC Housing Finance, LTI Mindtree, MRF, Nestle India, NMDC, ONGC, Petronet LNG, Samvardhana Motherson International, SBI, Tata Communications, Trent, Union Bank of India and Vedanta.

Although a same day settlement was in the planning stage for more than a year now, on March 15, Sebi in its board meeting had given it the go-ahead to launch a beta version and said it would review its progress after three and six months.

Last week, Sebi had asked market infrastructure institutions to work on the same. The new settlement cycle will be optional in nature for investors and it will have a separate trading window in which the trading for the day will end at 1.30pm. Sebi also said that some select brokers will be allowed to offer this faster settlement to its clients. Till late Wednesday, the list of selected brokers was not published by the bourses.

Under the T+0 settlement cycle, each stock will also have a price band that is plus-minus 1 percentage point of the same stock’s price in the T+1 cycle, a Sebi circular said.