New data shows that 2023 is shaping up to be the biggest year for Chapter 11 filings in over a decade, as a potent brew of economic troubles hit financially weakened companies. Chapter 11 bankruptcy filings typically involve debt restructuring. Though many companies survive bankruptcy, the uptick in cases is a stark reflection of the greater stress that businesses now face.

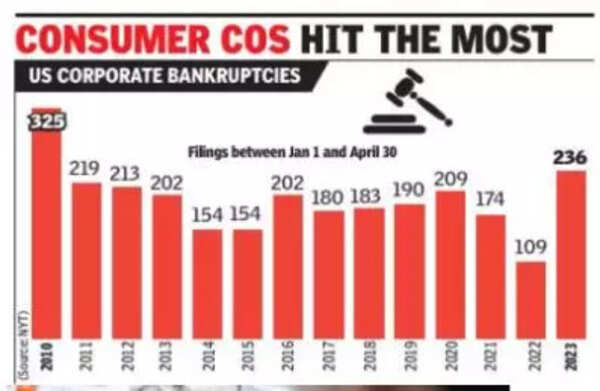

More than 230 American companies have filed for bankruptcy through April, according to S&P Global, the highest level over the first four months of any year since 2010. That number – which counts public companies with at least $2 million in assets or liabilities and private companies with $10 million in publicly traded debt – doesn’t include more recent cases, like Vice Media, Cox Operating and the KKR-backed Envision Healthcare.

Blame a slowing economy, fast-rising interest rates and persistent inflation, all of which have whacked companies struggling under heavy debt burdens and challenged business strategies. Lifelines like rock-bottom interest rates and pandemic-related government aid have also disappeared.

Struggling companies began laying off workers a year ago in an effort to reduce costs. But they are now “running out of time”, S&P analysts wrote in a research note on Wednesday. “Firms that were struggling well before the pandemic and the end of ultra-low interest rates have now gone to their breaking point.”

Consumer discretionary companies have been the busiest filers, according to S&P. That sector includes retailers and restaurants, typically among the most sensitive businesses to challenging economic conditions. Close behind are financial institutions – which saw an uptick in cases amid the regional banking crisis – healthcare companies and industrial producers.